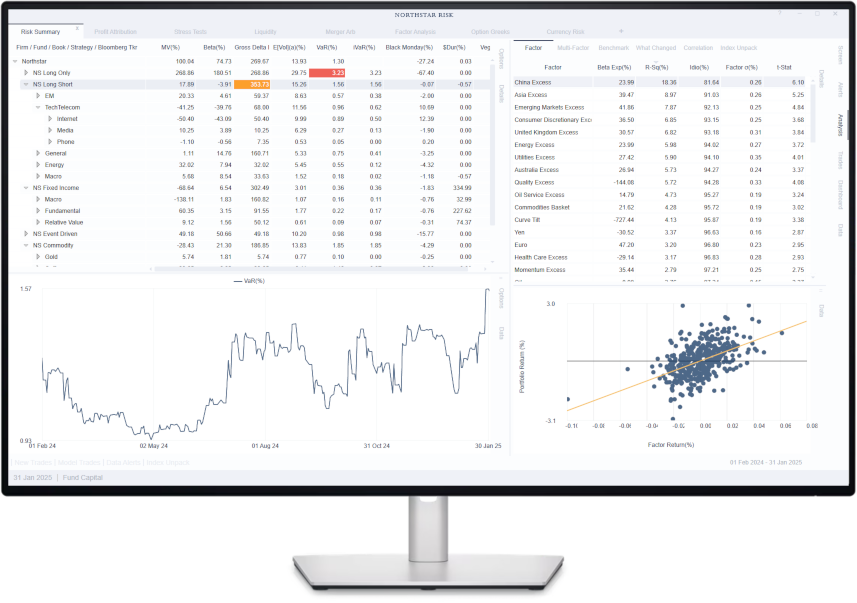

Integrated Portfolio Analytics

Are you adding alpha? Are factor exposures hurting or helping your performance? Is your portfolio too concentrated? Do you have too much risk? Not enough risk? The wrong risk at the wrong time? Our portfolio analytics can help you answer these questions and more.

Performance Analysis

Northstar Risk software provides detailed performance analysis, allowing hedge fund managers to objectively judge the performance of different strategies and to fully understand the drivers of past performance.

Our performance analysis platform is fully integrated with our risk analytics. The same factors that are used to analyze current risk, are also used to explain past performance. In the same way that you can group and drill down into your portfolio to better understand your risk statistics, you can group and drill down into your portfolio to better understand your performance.

Advanced Analytics

Just as with our risk statistics, our performance analytics are fully automated. Your performance numbers are always available and always up to date.

Our performance statistics include both simple and advanced measures. They include:

Attribution: market, sector, country, style, macro, alpha

Active vs passive attribution

Risk level attribution

Bayesian performance analysis

Hit rate

Superior Risk-Based Profit Attribution

Traditional profit attribution is based solely on profit and loss data. This is fine for long-only portfolios and for portfolios whose composition is constant over time, but for hedge fund portfolios the results of this analysis are often misleading.

To properly evaluate hedge fund performance, you need transaction data and security-level risk exposures. Using data and analytics from our risk engine, Northstar is able to provide accurate profit attribution, even for the most complex hedge fund strategies. Read more here.

For more information, or to schedule a demo, fill out our online form or e-mail us at info@northstarrisk.com.